Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

Beginning April 14, 2023, Note our NEW Address: 100 Jericho Quadrangle, Suite 233, Jericho, New York 11753

Ongoing trade war tensions between the United states and China continue to create uncertainty and add to fears of a global economic slowdown. However, recent negotiations between the Trump administration and China provide some hope that upcoming tariffs affecting approximately $160 billion in goods may be avoided.

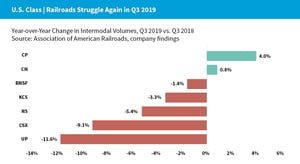

Although August through October typically marks peak season for shippers, third-quarter intermodal volumes have seen their sharpest decline since 2016, as predicted in the previous CAF quarterly forecast.

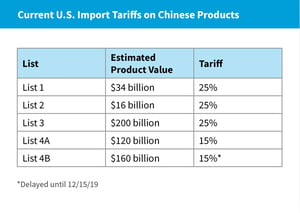

China Tariffs

China TariffsImplementation of List 4B tariffs was delayed until Dec. 15 amid concern that it would negatively impact holiday shoppers, especially those hunting for electronics. The combined lists include all apparel, footwear, and manufactured textile products, among others, but exclude specific medical and pharmaceutical goods, rare earth materials, and critical minerals. The administration also suggested that it may still be possible to avert the 4B tariffs altogether, if a new trade deal with China can be struck in the meantime.

While affected supply chains are certainly sourcing elsewhere or moving resources outside of China, the tariffs associated with these goods are still very new and many importers who believed apparel goods were safe from tariffs were not prepared. Since wearing apparel is a difficult industry to suddenly pick up and transport en masse, the tariffs may force the industry to identify long-term changes in that sector of international shipping.

Will the trade war be resolved ahead of the next round of tariffs? Well, recent history suggests a resolution in the near term is quite unlikely. China may be counting on President Trump leaving office before his first term is up and hoping his successor would be more amenable to ending the prolonged trade dispute.

There are signs of tensions thawing, however. The United States and China have held high-level discussions and there were reports of a “phase one” agreement, but the details remain unclear. The fact both leaders have been talking does allow for some optimism that something will get done to relieve tensions. China is being hurt more than they are willing, or permitted, to admit through their media outlets. The tit-for-tat tariffs are affecting China as much as, if not more, than they are impacting the United States. One major difference, however, is that the Chinese government can toe the line on messaging, which makes it difficult to say with any degree of certainty what the endgame will look like, or when it will come to fruition.

Synopsis: Although August through October has historically marked peak season for shippers, third-quarter intermodal volumes have seen their sharpest decline since 2016, as predicted in the previous CAF quarterly forecast. However, ongoing challenges and tariff-related disruptions to the normal business cycle may not account for the drop; improvements in technologies around supply chain management, inventory tracking, and demand prediction may also be playing a role in flattening out these historical peaks, along with shifts in consumer behaviors.

Synopsis: Election season has exacerbated passionate discussion surrounding plans for further port automation and its supposed negative effects on union laborers. United States and Canadian governments will be forced to respond to pushback against increased automation of work previously handled by humans amid a significant decline in union membership. Although the decision to automate is ultimately between the employer and labor, government support for longshore workers could have a ripple effect on the greater labor market.

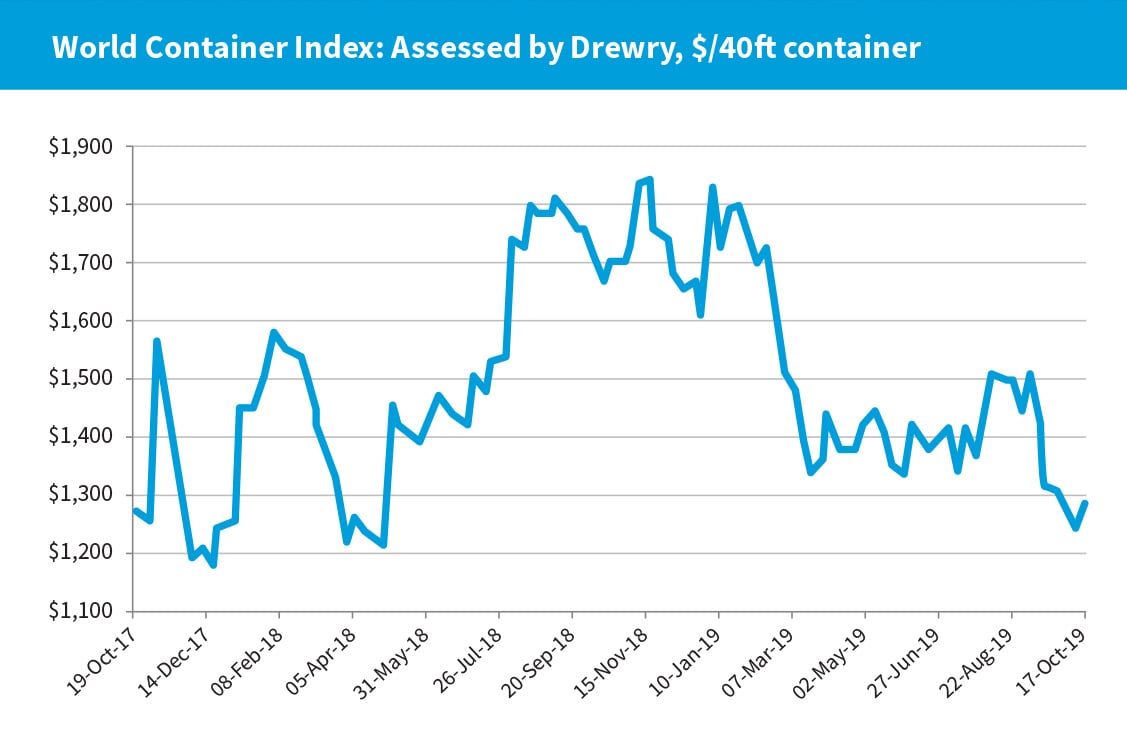

Air cargo continues to slump heading into the quarter, while blank sailings are on the rise. These may indicate smoothing of demand following pre-tariff frontloading, but both metrics bear watching.

The IMF indicates that global growth is slowing, while trade wars are costing the average U.S. household around $800 annually. In response, the Fed has cut interest rates to try to alleviate the blow on domestic businesses.

Following public scrutiny from President Trump, who has been calling for deep cuts in interest rates to alleviate the blows of his trade war on domestic businesses, the Fed cut interest rates for the second time in seven weeks, reducing the rate by a quarter point, from 2.0% to 1.75%.

Despite reduced interest rates, the International Monetary Fund (IMF) recently warned that the trade war—among other factors—would result in the slowest global growth rate since the 2008-2009 economic crisis. The world economy is expected to grow 3% this year, down from 3.2% predicted in July, with the 2020 estimate lowered to 3.4% from 3.5%.

Research by the Federal Reserve Bank of New York suggests the trade war will cost the average U.S. household more than $800 per year. That estimate was released prior to the most recent tariff increases, which affect such consumer products as children’s toys, smartphones, wearing apparel and footwear.

CAF was founded in 1982 with a vision to be an industry leading, full-service logistics provider.

Over the years we have weathered changes in the global distribution landscape by focusing on exemplary customer service and retention that is unparalleled in the freight forwarding industry.

Through the use of technology, experience, and highly trained personnel we provide our customers with the highest level of service and supply chain solutions. Our complete dedication to excellence has remained constant ensuring that our focus on providing the absolute highest quality service to our clients is never diminished.

100 Jericho Quadrangle,

Suite 233

Jericho, New York 11753

516-444-3700

Copyright 2024 CAF Worldwide. All rights reserved. Accessibility Statement

Copyright 2024 CAF Worldwide. All rights reserved. Accessibility Statement